Political Showdown: College Tuition Crisis

Presidential Candidates Edition

As the nation’s student-debt tab has raised to $1.2 trillion, according to The Washington Post, students are eager to find a solution to the tuition crisis in an era where it is required to get a college diploma to land a stable job.

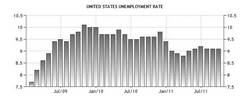

The average student in the class of 2015 would be paying back $35,000 in loans (not including graduate school!), making them the most indebted class ever. Six months after graduating, many will have to start paying their debt back, in an economy where about 8.5 percent of college graduates between 21 and 24 are unemployed, according to the Economic Policy Institute.

To work hard for four years, graduate, and automatically feel stressed about how you are going to pay off your loans can be a huge burden on someone. The luxury of trying to save up money for that white picket fence is no longer there. Instead, the life after college is living pay check to pay check.

With this, stagnant wages, declining federal and state funding to schools, and rising tuitions, many families only have the choice to either borrow money or send their children to a cheaper schools. Why should a person’s education be based on their monetary funds and not on their quality of work?

Many presidential hopefuls have mentioned lessening the burden of college education debt, but Bernie Sanders has brought up a detailed plan to his objectives.

Sanders said “We have to make sure that every qualified American in this country who has the ability and desire to go to college is able to go to college, regardless of the income of his or her family,” he said.

This is why Sanders introduced the College for All Act, a bill that would eliminate undergraduate tuition at four-year public colleges and universities through financial transaction tax of Wall Street trading.

Octavia Savage, who graduated from Bloomfield College in New Jersey, considers herself lucky to be graduating with only $26,000 in debt. She said “The average student leaves with even more debt. But I’m worried about six months from now when I’m going to have to start paying it back. How am I going to do that? And if I can’t, it’ll start to affect my credit score, and in the future I won’t be able to purchase what I want even if I have a good job because my score will look like I’m not responsible. ”

As an undergraduate student, Savage worked a number of minimum wage jobs just afford tuition and books, but now that she is a 21 year old graduate, she’s living with her father in Newark and she feels stuck.

“I’m ready to move out. I’m 21 years old! I should be moving out but unfortunately I can’t afford to live on my own,” she said. “I also see my younger siblings and my community wishing to go to school but not able to get the loans and grants they need.”

The time she spent working could could have been spent focusing more on her education or even saving up money to move out, but unfortunely that was not possible.

With Sander’s plan, the federal government would pay for two-thirds of the cost of public college tuition, and the states would put up the other third. The schools would not be able to use federal money to increase administrator salaries or build non-academic buildings, giving the money straight to student education. With this, there will also be an expansion on federal work study programs and make them more accessible to students.

If this bill was to be signed, the US would be in the lines with Brazil, Chile, Finland, Germany, and other countries that provide tuition free higher education.

The plan would cost over $750 billion over the next 10 years, which is nothing compared to the amount of debt that has accumulated over the years, hurting credit scores and finical success across the country.

The government is currently spending nearly 70 billion a year for most grants, tax breaks and according to ATLAs Analysis. These numbers will only continue to rise as tuition rises, as it has over the last five years (over 25 percent). If colleges were to switch to a free tuition based education, it would save tax payers money and make private institutions lower their tuition in order to compete.

Rubio has also stated to be in favor of for-profit colleges, especially Corinthian Colleges, which the U.S. Department of Education fined for misrepresentation of job placement rates to current and prospective students. The Department found 947 misstated placement rates and information.

Rubio’s responds to this was “While I commend the Department’s desire to protect our nation’s students from fraudulent and malicious activity by any institution of higher education, regardless of tax status, I believe the Department can and should demonstrate leniency as long as Corinthian Colleges, Inc. continues to expeditiously and earnestly cooperate by providing the documents requested.”

Sanders said, “It is totally unacceptable that Americans are drowning in $1.2 trillion in student loan debt. It is unacceptable that millions of college graduates cannot afford to buy their first home or their first car because of the outrageously high interest rates they are paying on student debt.”