Aside from the impending December 21, 2012 doomsday, Americans of all socioeconomic backgrounds should become well aware of the fiscal Armageddon that will take place on January 1, 2013 should Congress fail to act.

Beginning in January, the selfimposed crisis known as the “fiscal cliff” will take effect and cause $7 trillion worth of spending cuts and tax hikes over 10 years.

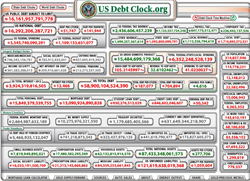

In the summer of 2011, Congress found itself in what seemed to be unending gridlock over the issue of raising the limit placed on borrowing through the selling of United States Government Bonds. The congressional impasse on raising the maximum limit on borrowing, known as the debt ceiling, put the United States on track to default on its financial obligations to creditors from all over the world.

Finally in August 2012, Congress reached a deal that temporarily raised the borrowing limit and allowed members of Congress the opportunity to avoid difficult, permanent decisions until after the 2012 election. In exchange for more time and to pressure Congress to work together, members of both parties agreed to cuts in military and domestic program spending.

In an attempt to illustrate the severity of the consequences of failing to reach an agreement by January 1, Federal Reserve chairman, Ben Bernanke, alluded to the American economy tipping over the “fiscal cliff.”

The elements of the fiscal cliff are the outcome of this deal timed with the expiration of the tax cuts passed during President George W. Bush’s term in office. Should Congress fail to reach a deal, the American economy would take an automatic hit of $500 billion in government spending and tax increases on most working Americans for the fiscal year 2013.

Although most economists agree that budget deficits are too high and that cuts in spending are reasonable policy changes, most also agree that cutting spending too quickly will imperil the U.S. economy that is sluggishly recovering from the worst economic crisis since the Great Depression.

On December 31, 2012, $400 billion worth of tax cuts for 2013 alone will expire and effectively raise taxes on most Americans. All of the Bushera tax rates and President Obama’s 2 percent payroll tax cut that put an average of $1000 back in the pockets of all Americans per year are set to end. Regular income tax rates will go from 10, 15, 25, 28, 33, and 35 percent to 15, 28, 31, 36, and 39.6 percent.

The capital gains tax that is imposed on the sale of non-inventory assets such as stocks and bonds will increase from 15 to 20 percent, Child Tax credits will drop from $1000 to $500 per child, and the American Opportunity Tax Credit for qualifying college tuition expenses will drop from a credit of up to $2,500 per student to $1,200.

Associate Professor of Accounting, Paul G. Savoth, who completed a Master of Laws in taxes, remarked that the “United States’ tax code is too complex.” When asked to propose possible solutions, Savoth “Hoped that Congress took this opportunity to permanently reform the system to make it fair and encourage economic activity.”

On fiscal spending, the government made the consequences of the fiscal cliff simpler, yet far-reaching. If Congress fails to act, $55 billion will be cut from discretionary defense spending. Another $55 billion on domestic programs including education will also be usurped from the American economy. Some believe these spending reductions seem like great ideas in the face of increasing annual deficits. They make cuts in the wrong places. Congress needs to address the fiscally devastating issue of entitlement spending. This involves programs such as Medicare, Medicaid, and Social Security Insurance.

Savoth called on students to pay attention to this debate because it could “fundamentally change the way Social Security Insurance and Medicare function when young people begin to retire in the future.” According to the Heritage Foundation, the three largest programs, Social Security, Medicare, and Medicaid make up 44 percent of the Unites States’ annual budgets.

Following the re-election of President Obama, Congressional leaders of both parties seemed optimistic about the possibility of reaching a compromise that would avert the looming crisis. This would obviously be in the interest of all Americans, but to college students it is increasingly important because spending cuts and tax increases will ultimately affect the job market. With higher taxes, businesses could feel less inclined to hire new employees, invest in new equipment, and even cut existing positions.

When asked about the anxiety of entering the job market after graduation under these conditions, senior political science major, Miriam Peguero commented that she was “Genuinely worried about finding a position that is relevant to her work in college.”

No matter what issue arises in Congress; the overwhelming concern of students, faculty, and everyday Americans is jobs. When asked about her greatest fear after graduation, senior marketing major Samantha Hopkins commented that her greatest fear was “not finding a job and being unable to pay back student loans.”

These fears are very real and common on college campuses. For now, students like Peguero and Hopkins can be cautiously optimistic. Despite a weak recovery, the economy is growing and the job market is healing. In October, the national unemployment rate slightly ticked up to 7.9 percent from 7.8 percent in September. According to the US Labor Department, the state unemployment rates in 23 out of the 50 states are now below six percent. Every American should hope that Republicans and Democrats in Congress work together, find permanent solutions, and aid the recovery. Preventing the fiscal cliff and removing the economic uncertainty is a great start.

IMAGE TAKEN from usdebtclock.org