For many, to attend college is to live out a dream; however, that’s not to say the college experience is without its drawbacks, one of which is the cost of living. Plenty of college students find it difficult to budget their money and to prioritize their essentials over their wants. If you find yourself constantly thinking about money, it’s time to sit down and start a budget for yourself.

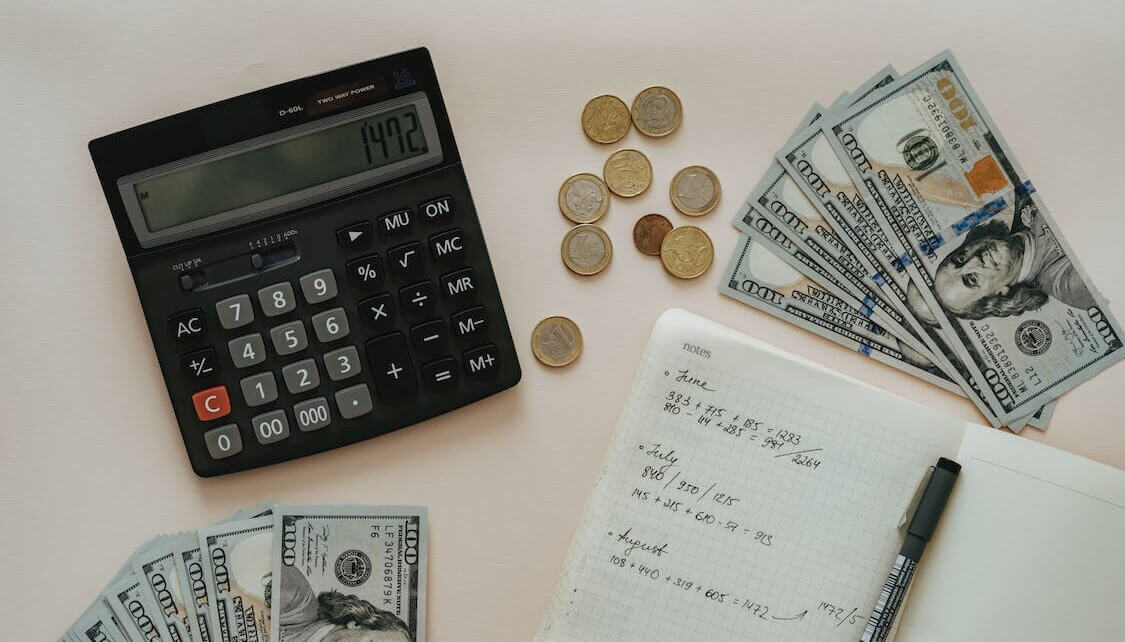

Start off by calculating your necessities. Add up everything that you must pay for the month—rent, utilities, car payments, insurance, phone payments, etc.—and come up with a total for your necessities.

Now, figure out how much you’re making at your current job or how much you would be making with the number of hours you would like to work during the school year. If this number is below that of your necessities, it might be time for a new job or to increase your hours at work if you can.

If you have money left over after accounting for your monthly expenses, it’s time to decide how much of this you would like to devote to different spending categories, some examples being entertainment, groceries, clothes, and dining out.

Try to be realistic with your spending within each of your categories and prioritize those that may be more important than others. For example, dining out can really add up, so try to prioritize your groceries category so you get more bang, or in this case food, for your buck.

Buying new clothes every month can also be an unnecessary expense. Try to come up with new outfits with the clothes you already have by mix-and-matching different pieces.

Senior marine and environmental biology and policy student, Marie Mauro, advises, “Only spend money to go out to eat once a week and eat in every day, and don’t buy new clothes unless you really like them.”

It’s important to still do the things you enjoy while in school but try to do so in moderation in order to stick to your budget. Going out for drinks or getting food with some friends can be fun, but it’s not something you need to do every day or even every week.

Instead, try to come up with some fun activities you and your friends can do together instead of breaking the bank. This could be just having some drinks at your own house or dorm or having a fun make-it-yourself pizza and movie night with friends.

If there are things you feel that you really want to buy—clothes, shoes, etc.—give yourself a couple of days to make your decision. Oftentimes we want things in the moment because they’re right in front of us but after a couple of days we’re not as tempted. If after this time you still find yourself thinking about that item, then consider splurging on it if you can.

If you are able to, try to add into your budget a savings goal for every month. You could set aside as little as $20 a month if that’s all you can do at the moment, but it’s important to establish some kind of savings if you can. This could help with unexpected expenses, or you could use this money for items you want to spend a little more on.

Einat Shayer, a senior marine and environmental biology and policy student, explained, “I have a box that I leave leftover cash in and don’t open it until a big investment. I paid for my laptop with this leftover money.”

Whatever your situation, money can be a stressful topic for college students. Budgeting can help you manage this stress by showing you where you have a little wiggle room and where you can improve your spending.