The other day, my friend looked into his wallet and realized that all the money he had on him was gone, which bewildered him because he has just gotten paid the week before. He then decided to check his debit card balance. Wide-eyed and jaw-dropped, he realized that he only had $2.64 left to spend. I then went on to ask him, “Well, where did you go this past week? Did you need to shop for food, did you need to go home over the weekend on the train?” All he responded back was. “No.” After sitting silent for a few moments, he told me he needs to learn control and how to save; something I have been very successful in these past few years.

When entering college, all any young adult thinks about is the freedom they inherit as they walk through the doors their first day, but not all freedom is fun and exciting. Some can actually be extremely stressful. Saving money and learning how to budget are two key components of becoming an adult, but it can be extremely difficult if no one has ever properly taught you how to do them. Personally, I started about learning money at a young age due to my grandmother being a book keeper at a near-by school district; make sure to spend as little as possible, make sure that you use discounts and coupons, and make sure you take advantage of their sales and holidays. As the list went on and on, I found myself thinking that it was a waste of time. I mean, who uses coupons besides old people, right? Who can sit there and wait for that shirt they want until it goes in sale in a month? None of these pertained to me, so I wasn’t specifically trying to follow these guidelines. Another reason that I did not want to think about saving my money at a young age was because my family had always supported me, buying my clothes and providing money for fun activities along with necessities. But, unfortunately, life was unable to go on with that being the case and I had to learn the hard way that, sadly, my grandmother was right.

Though I have my own way of saving, I found myself sitting in my first-year seminar class, listening to Professor John Buzza teach us the importance of keeping your money. As he walked us through an exercise that made us all realize how expensive the real would can be and how much we would need to make a year to break even. Forty-five thousand dollars before taxes. That is the salary you need to have right out of college for you to get by, and we didn’t even get a chance to factor in how often you eat out, how much you are paying back in student loans, or even how much you need just for your personal hygiene products. Crazy, right?!

After class, I went to visit Professor Buzza in his office to ask him what are some key points in saving your money and how would he recommend us, as young college students, be money smart. The first thing he spoke, and the one idea that he repeated many times, was “START YOUNG!” Going on, he explained that if you start now with putting money aside instead of spending it on a pizza or new sneakers, you will be extremely happy with how much you save at the end of a week, at the end of the month, and especially at the end of a year. Not only does this allow you to have some extra dough, but the professor also highlighted the fact that it will develop the habit of saving. In his example, he puts it this way:

“It doesn’t matter what you save, or how you save it. If you have a change jar and put all the loose change in your pockets at the end of the day, that’s great. You then can gradually move up to a dollar a day, then two dollars a day. You can even be courageous and say to yourself, ‘wow, maybe I will take five percent of my entire paycheck and put it into a savings account that I will not use unless I have to.’ Cutting down on things that aren’t necessities, such as buying Starbucks every day, will get you to reach your goals faster.”

Although saving can be painful and no one wants to admit they need to become responsible and hardworking, every college student needs to save.

“All it takes is faith, trust, and a little [extra push to become a great saver and an amazing investor].” I know I already bought a mason jar and labeled it: “Savings – Start Small, End Huge.” This is a lesson that all college students could and should learn from!

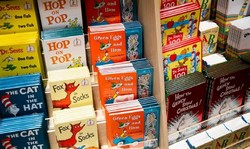

PHOTO TAKEN by Alexandria Afanador