Over the past 30 years, the average tuition and fees for public four-year universities tripled, and more than doubled at private nonprofit four-year institutions, according to College Board. Nationally, student loan debt as a whole has accumulated to $1.52 trillion during the Millennial lifetime.

Millennials are defined as those born between 1981 and 1996, according to The Pew Research Center. With the oldest Millennials around 40 years of age and the youngest around 23, current college-age students are categorized either directly as Millennials or on the cusp of qualification.

LendEDU, an organization which publishes an annual report detailing student loan debt per state, ranked New Jersey within the top 10 for highest student debt post-graduation, last August. The study found that the average student loan debt per borrower for New Jersey was $33,593, and 64 percent of New Jersey college students graduate with student debt.

Although the report goes into detail regarding the average student loan debt per borrower and the percent of graduates with student debt of other New Jersey schools, specific Monmouth University numbers were not listed.

Claire Alasio, Associate Vice President for Enrollment Management and Director of Financial Aid, explained the logistics behind scholarships available to Monmouth undergraduates.

“The University spends roughly $66.1 million in scholarships to 4400 undergraduate students,” Alasio said. “That’s around 17k per student, which is a pretty significant commitment on the University’s part. That’s a significant way that we’re hoping to reduce student debt.”

According to the official Monmouth website, for 2019-20, the annual cost for tuition and fees for full-time students is $39,592. Any student who resides on campus or within University-sponsored housing can also expect, on average, an additional $14,520 annually for housing and meals for a total cost of $54,112.

However, 97 percent of undergraduates last year received some form of financial aid, the Monmouth website goes on to mention. Ninety-three percent of undergraduates received a scholarship or grant (federal, state, or University), and the average scholarship/grant package granted was $19,335.

The Financial Aid Office puts an emphasis on students applying for any and all federal state funding to which they may be entitled, Alasio said. “We do a lot of research in this office to find private scholarship opportunities for students. The Monmouth website also has a searchable database of all the scholarships that come to our attention, and any student can go on and look at what they qualify for as well as apply for it.”

Amongst the undergraduate students (both new freshmen and transfers) who graduated during 2018-19, 75 percent of all graduates took out some federal loan funding, according to Alasio. The average federal loan debt for those who did have loans was $25,276.

Jessica Ciccone, a junior business student, showed concern over the student loans she acquired as a freshman.

“It’s scary to borrow money without an idea of how you’ll pay it back one day, even with the help of financial aid” Ciccone said. “I know the idea is that by getting a loan now, I’ll be put in a position to enter a high-paying job later, but life isn’t always so black and white.”

A student is considered to be in “default” when they have not made a payment on their loans in more than 270 days post-graduation, Alasio explained. Monmouth has the third lowest default rate for all institutions in the state, only behind The College of New Jersey and Stevens Institute of Technology.

“Our default rate is only 3.8 percent,” Alasio said. “Our students are paying their loans back, and I think part of it is they understand the responsibility of having a loan. That comes from good information and counseling from the Financial Aid office, and I think it also speaks to the fact that our students are employed after they graduate. If you’re employed, you’re more likely to have money to pay your loan.”

It is important for students to understand the difference between “good” and “bad” debt, Alasio said. Taking a loan out for education can be considered a worthy investment in the long term, although intimidating at first when the rewards do not immediately present themselves.

“I think that most people would argue, taking out a loan for education is good debt,” Alasio said.

“Part of the problem is that students, while they’re in the thick of it, don’t necessarily see the value of their education until they’re working in their chosen field using the knowledge and experience gained during their undergraduate career. If you can’t see the immediate value in something, you may wonder why you’re making the investment.”

Nancy Uddin, Ph. D, an Associate Professor of Accounting, offered general advice regarding how the average student can best manage and prepare for their debt prior to graduation. On the subject of loans, Uddin suggests students should attempt to borrow the least amount possible.

“When borrowing money, students should try to borrow at the lowest interest rate possible and read the terms of the contract carefully,” Uddin said. “When does interest begin to accrue? When do the payments begin? What is the minimum payment? Are there other ways to ‘pay back’ the loan, such as Peace Corp Service, service to rural areas, etc.? Can you complete the first two years of study at a lower cost Community College and then transfer to your school of choice? Students can also consider moving to States that have a lower cost of living as a viable option.”

Having an understanding of one’s own personal finances can be helpful to managing debt, Uddin explained.

“Everyone, regardless of age, should have a personal budget: a log of monthly income, expenses, and savings to help them manage their finances,” Uddin said. “Students should also research the average entry-level salary for their expected career path and estimate how much debt payment they can afford after accounting for living expenses.”

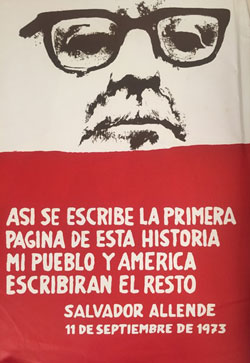

PHOTO TAKEN by Matthew Cutillo